Cumulative distributed energy resource capacity in the United States will reach 387 gigawatts by 2025, according to a new Wood Mackenzie report.

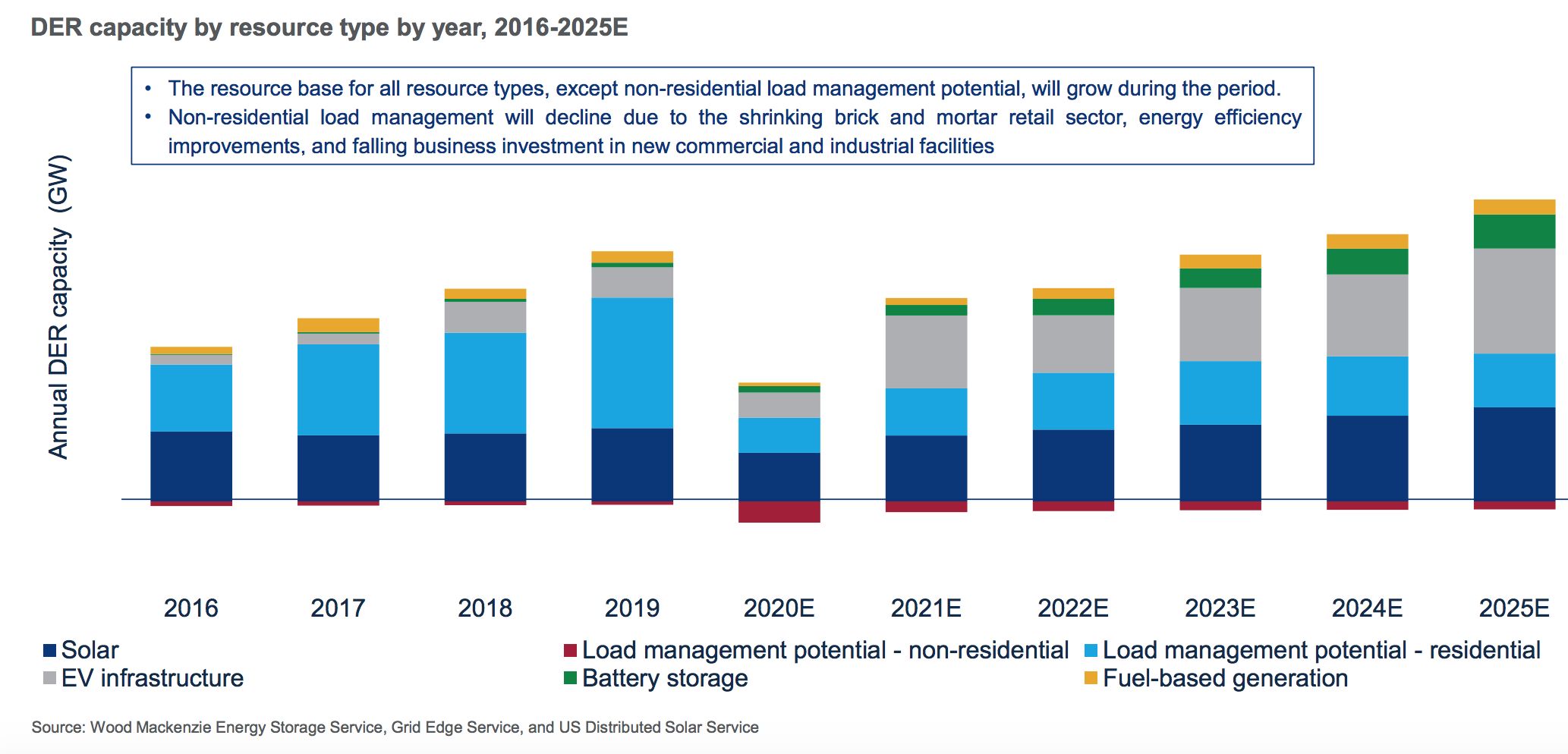

The DER mix is evolving quickly away from nonresidential load management, which made up two-thirds of all U.S. DER capacity in 2015 but will make up less than half by 2025.

The solar, electric vehicle infrastructure and residential load management potential install base will account for more than 90 percent of DER capacity installed between 2016-2025.

Cumulative U.S. DER investments will eclipse $110.4 billion between 2020 and 2026. Solar, EV infrastructure, battery storage and grid-interactive water heaters sales growth will drive spending to a new peak in 2025.

Hundreds of gigawatts of DER capacity in the balance

According to the North American Electric Reliability Corporation, which regularly assesses the balance between supply and demand to ensure reliability, the need for demand response in North America will remain flat at around 35 gigawatts through 2025. However, NERC’s assessment of demand response needs is based on a traditional approach to resource planning.

The total DER capacity from residential load management, distributed solar, distributed storage, EV charging and distributed fossils will exceed the reliability requirement assessment by 352 gigawatts by 2025. The presence of DERs on the grid at far greater volumes than the demand response needs for reliability forecast by NERC underscores the untapped potential for DERs to shape load and integrate renewables onto the grid.

A new phase of grid planning is on the horizon in the U.S., though progress has been slow.

In September 2019, the Federal Energy Regulatory Commission concluded that it is interested in further exploring the interconnection of distribution-connected DERs, including load management opportunities. FERC’s pending rulemaking on aggregated DERs will significantly impact how load management potential will be used to provide system flexibility, reliability and resiliency. In the meantime, these DERs will provide valuable services to customers by reducing load, demand peaks and exposure to dynamic rates, in addition to improving comfort and customer control.

The DER market is not insulated from COVID-19 impacts

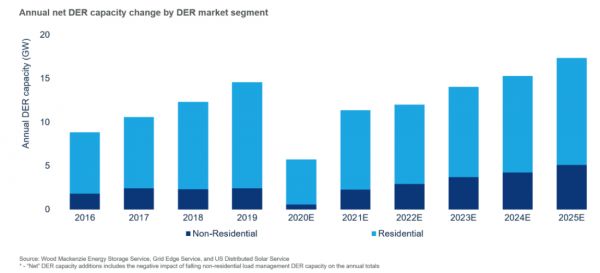

The COVID-19 pandemic and coming recession will have a very significant impact across DER markets in the United States, with annual DER capacity additions falling by 48 percent in 2020.

2020 will be the first year the market doesn’t grow year-over-year in more than a decade, according to WoodMac. The U.S. DER market will experience a recovery in 2021 but will not exceed its pre-outbreak high until 2024.

Analysts have identified several factors that could accelerate or hinder DER growth in the U.S. over the next five years. The most critical factors include retail rates, consumer demand, and macroeconomic conditions related to COVID-19.

More widespread use of dynamic rate determinants in customer utility billing (including time-of-use, demand charges, critical peak and real-time rates) would create greater opportunities for the DER market.

California is the main market to watch for residential dynamic rate adoption. Between 2018 and the end of 2020, more than 10 million residential customers will be transitioned to a time-of-use rate in California, assuming the state's Public Utilities Commission does not delay the rollout due to the economic effects of the coronavirus pandemic.

This alone will more than double the number of customers on dynamic rates in the U.S. to more than 18 million customers. If dynamic rate determinants become more common in the next five years, they will improve economics for storage, residential load management, private EV charging and fuel-based generation.

As for consumer demand and macroeconomic conditions, the likely onset of recession in 2020 is poised to have an impact upon every DER type. Lower economic activity and higher unemployment will decrease both consumer disposable income and business investment in the early 2020s.

***

A free executive summary of Wood Mackenzie’s first-ever U.S. DER Outlook Report is available to download for free. The report combines 29 forecasts across six different customer-sited resource classes (distributed solar, distributed storage, residential load management potential, non-residential load management potential, EV infrastructure and fuel-based generation). This report covers the full range of customer-sited distributed energy resources, providing a view of potential DER capacity from 2016-2025.